Weekly Market Commentary

THE WEEK IN REVIEW: January 12, 2025 – January 18, 2025

Markets perk up ahead of the inauguration

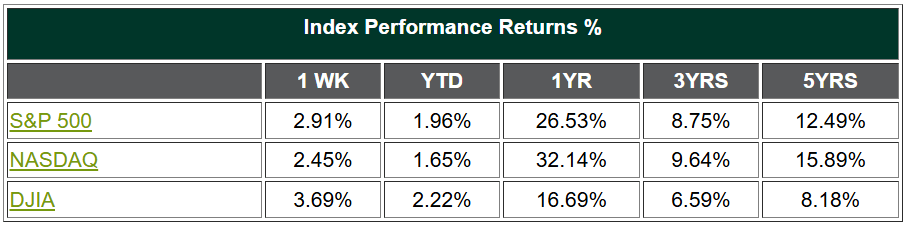

After a fresh dose of optimism, some strong earnings and the inflation reports for December (which weren’t great but also weren’t horrible), the markets took off last week and reversed the recent slide to close out their best week since last November.1 The announced ceasefire between Hamas and Israel renewed hope that conflicts in the region were coming to an end.2 Small caps had a super week as the on-again, off-again Trump trade seemed to be on again.3

The saying, “As goes January, so goes the rest of the year,” had us worried for a while as we struggled to get traction.4 It seems that when January is positive, the market is more likely to put in a positive return for the year. Sure, it’s not out of the question to have a good year with a weak January, but why tempt fate? It’s better to play the odds.

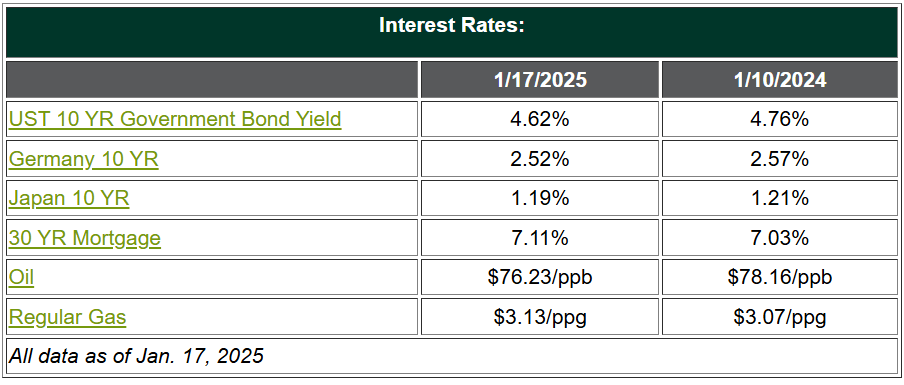

The Consumer Price Index (CPI) and Producer Price Index (PPI) for December both came in mostly in line with or slightly lower than expectations, which the markets needed to see after the robust jobs number the week prior.5,6 All the talk had been about stubborn inflation, a strong economy and the possibility that the Fed would only cut once this year or maybe not at all. The 10-year treasury was pushing upward toward 5% (more detail in the section below) in a sign that inflation was far from contained and the Fed had not done its job.7

Then CPI came in at 2.9% year-over-year for December, 0.2% higher than the prior month. Energy, food, vehicles, car insurance and airline fares were the usual culprits contributing to the increase, but Core CPI showed some disinflation, as did shelter prices.8 After a depressing couple of weeks, that was enough for the markets to stage a quick reversal last Thursday and Friday. Strong earnings from major banks pitched in as well.9

There was also news that a ceasefire was reached between Hamas and Israel and that the remaining hostages would be released.10 This happening days before Trump took office wasn’t surprising, given that Trump had signaled “all hell will break out” if the hostages were not released by the time he took office.11

Markets took the news as a sign of a return of stability, and we saw a resurgence in sectors that seem to benefit from the optimism surrounding Trump — specifically small caps, which were floundering. Small-cap stocks rallied last week, after bouncing off their 200-day moving average as they attempted to recover from their slump over the past month. The Russell 2000 index, a measure of small-cap equities, was up around 4% last week and was on track to post five straight days of gains.12 The index was rebounding from a 3.5% loss the prior week and was down more than 2% over the past month based on last Friday morning’s trading levels.

Markets seemed to like what they saw and heard globally, economically and politically last week, so we are back on track for a solid January and a solid start to 2025!

Back to the Goldilocks scenario as yields retreat

The fever that the 10-year U.S. treasury was running appears to have broken, for now. The benchmark 10-year note yield edged up 1.3 basis points on Friday to 4.619% but has eased off a 14-month high of 4.809% hit earlier last week. Federal Reserve Governor Christopher Waller indicated on Thursday the central bank could cut rates sooner and faster than expected as inflation will likely continue to ease — hard to believe given that we have hovered between 2.4% and 3.0% on the CPI year-over-year since June 2024. 13,14

After the past few weeks of grousing about the lack of potential rate cuts this year, the markets snapped back last week. Whether it’s the wishful thinking of a “soft landing” for the economy or the “Goldilocks scenario” for stocks bedtime story (where the Fed can ease rates down while taming inflation and keeping the economy on track), the markets seemed to buy into the possibility of one or both. 15 Sure, it may all work out, but it’s best not to allow what we want to happen monopolize thinking while we discount other equally plausible possibilities. That’s called Asymmetric Bias — and wanting it does not make it so.

This market is tight as a drum, valuations are stretched and inflation is still with us. Bonds were telling us that things weren’t as rosy as we thought, and we were struggling but markets were in a better mood for one week. Now we need to see if we can get on a roll.

Coming this week

- This is another short week for trading, as markets were closed in observance of Martin Luther King, Jr. Day on Monday. Maybe the markets are telling us they want a four-day work week?

- Monday also ushered in a new administration. Right now, markets are optimistic, and we need to watch how things unfold.

- The first day we’ll see any data this week will be Wednesday, with MBA mortgage applications and leading indicators. We’ll also see unemployment claims on Thursday, then existing home sales, consumer sentiment (which will give us a pulse on consumer optimism), flash services and manufacturing PMI on Friday.

Sources:

1 Chuck Mikolajczak. Reuters. Jan. 17, 2025. “Stocks rally to close out strong week, await Trump policies.” https://www.reuters.com/markets/us/futures-edge-higher-with-all-eyes-trump-inauguration-2025-01-17/. Accessed Jan. 20, 2025.

2 Lucia Suarez Sang and Haley Ott. CBS News. Jan. 20, 2025. “Israel-Hamas ceasefire deal begins with release of Israeli hostages, Palestinian prisoners.” https://www.cbsnews.com/news/israel-hamas-ceasefire-hostage-release-gaza-war-takes-effect/. Accessed Jan. 20, 2025.

3 Lewis Krauskopf. Reuters. Jan. 17, 2025. “Wall St Week Ahead: Small caps lose Trump bump as rising rates sap strength.” https://www.reuters.com/markets/us/wall-st-week-ahead-small-caps-lose-trump-bump-rising-rates-sap-strength-2025-01-17/. Accessed Jan. 20, 2025.

4 Fidelity. Feb. 1, 2024. “The January barometer.” https://www.fidelity.com/viewpoints/active-investor/january-barometer. Accessed Jan. 20, 2025.

5 U.S. Bureau of Labor Statistics. Jan. 15, 2025. “Consumer Price Index – December 2024.” https://www.bls.gov/news.release/pdf/cpi.pdf. Accessed Jan. 20, 2025.

6 U.S. Bureau of Labor Statistics. Jan. 14, 2025. “Producer Price Index News Release Summary.” https://www.bls.gov/news.release/ppi.nr0.htm. Accessed Jan. 20, 2025.

7 CNBC. “U.S. 10 Year Treasury.” https://www.cnbc.com/quotes/US.10. Accessed Jan. 20, 2025.

8 Will Kenton. Investopedia. June 27, 2024. “Core Inflation: What It Is and Why It’s Important.” https://www.investopedia.com/terms/c/coreinflation.asp. Accessed Jan. 20, 2025.

9 Matt Ott. AP News. Jan. 15, 2025. “JPMorgan posts record annual profits as major US banks thrive in the final quarter of 2024.” https://apnews.com/article/jpmorgan-chase-bank-earnings-profit-38c5a832fdb4503d8483d6115b4a8ee1. Accessed Jan. 20, 2025.

10 Mohammed Salem, Nidal Al-Mughrabi and James Mackenzie. Reuters. Jan. 20, 2025. “Hamas frees hostages, Israel releases Palestinian prisoners on day one of ceasefire.” https://www.reuters.com/world/middle-east/gaza-ceasefire-hostage-release-set-begin-2025-01-19/. Accessed Jan. 20, 2025.

11 Laura Kelly. The Hill. Jan. 7, 2025. “Trump: ‘All hell will break out’ if Hamas hostages not released by inauguration.” https://thehill.com/policy/international/5071625-trump-warns-hostage-release/. Accessed Jan. 20, 2025.

12 CNBC. “Russell 2000 Index.” https://www.cnbc.com/quotes/.RUT. Accessed Jan. 20, 2025.

13 Howard Schneider and Ann Saphir. Reuters. Jan. 16, 2025. “Fed may cut rates sooner and faster than expected if disinflation holds up, Waller says.” https://www.reuters.com/markets/us/feds-waller-cuts-could-come-sooner-than-later-if-disinflation-meets-expectations-2025-01-16/. Accessed Jan. 20, 2025.

14 US Inflation Calculator. “Current US Inflation Rates: 2000-2025.” https://www.usinflationcalculator.com/inflation/current-inflation-rates/. Accessed Jan. 20, 2025.

15 James Chen. Investopedia. May 25, 2024. “Goldilocks Economy: Definition and What Makes It Work.” https://www.investopedia.com/terms/g/goldilockseconomy.asp. Accessed Jan. 20, 2025.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

01/25 – 4122384-3

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.