Weekly Market Commentary

THE WEEK IN REVIEW: October 13, 2024 – October 19, 2024

The only “October surprise” so far has been a record-setting stock market run

Markets continue to defy historical trends. After a pretty good September, the good vibes have continued into the first three weeks of October. Records are being set, and two months that have traditionally been the source of pain for market participants have become a surprising font of joy instead.1

There are some lessons here to heed. Let’s use the Dow to illustrate: At the start of September, we were riding high as the Dow closed above 41,500 (an all-time high at the time). But almost on cue, we saw the Dow tumble 1,200 points in the first week of trading, and people started to fear that we were entering into an easily foreseen and avoidable sell-off in what we have historically experienced as a weak season. Market timers rejoiced because they jumped out at 41,500. Fast forward six weeks later, and we are over 43,000 on the Dow, a new record and 4% higher than that record August close.2

The lessons? First, markets are unpredictable but seem to always find a way to move higher. Second, think like an institution. Long-term planning and investing always seem to come out ahead. And finally, we advise you to never try to time the market and think you are smarter than the rest of the world. The adage “don’t buy high and sell low” is true and tested, and people always astound with what they can convince themselves of and the magnitude of their mistakes.

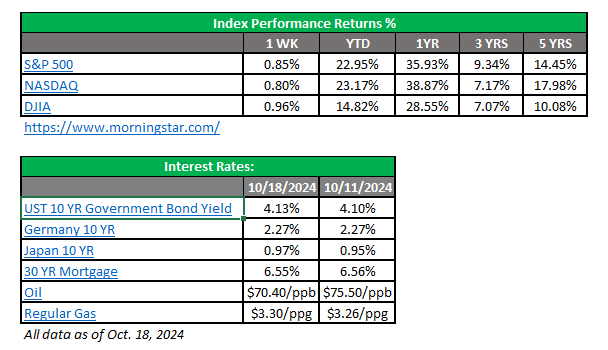

With all that, we saw new records for the Dow (43,275.91) and the S&P 500 (5,864.67) on Friday.3 The Nasdaq is also closing in on its record set on July 10 (18,647.45) when it hit 18,502.69 on Monday.4 For now, it is all systems go as we seem to have found the sweet spot between a soft landing, the beginning of a rate-cutting cycle from the Federal Reserve and a fairly unremarkable October before an election — and that might be the biggest surprise of all!

Does it seem like we’re discounting tense global situations?

Israel and Iran, Russia and Ukraine, China and Taiwan — all of these relationships are tense, to say the least. But it seems like markets are ho-hum about all of these situations.

Israel said it would not attack Iranian oil or nuclear facilities but would respond to Iran’s drone attack prior to the U.S. election.5 What kind of nonsense is that? A country fighting a ruthless foe who wants to wipe them off the map would typically not tip them off and give up the element of surprise. Does anyone believe that? Well, the energy markets bought it as oil slid from $75 to below $70 in response to the news.

The conflict between Russia and Ukraine continues to be a stalemate that can escalate into something more severe, especially since no one seems to be trying to resolve it.6 Then there’s the daily activity between China and Taiwan; one misstep from a lower-level military person could literally spark a war. That would move us into a direct military engagement with China because the U.S. administration has stated publicly that we would defend Taiwan.7

With this much potential upheaval, it’s surprising that the volatility index (VIX) is under 20.8 We have had some bouts of volatility in the second half of 2024, notably in early August and again in September. And it seems likely something will spark more volatility before year-end. But just like September and October have defied convention, so, too, might this really active and dangerous geopolitical landscape. Does the market know something we don’t or are we willfully ignoring real warning signs?

Coming This Week

- Now that we’re more than halfway through October, most of the data of importance has filtered through. After the September rate cut from the Fed ended the rate-hike cycle and moved us into an easing cycle, the markets looked to upcoming jobs and inflation data to gauge how much more and how quickly we could expect additional cuts. The data hasn’t really cooperated with those hopes, and despite the modest declines in inflation and slower job growth, the rate of improvement appears to have stalled. For the Fed to cut more aggressively, we need to see inflation decline more and for jobs to weaken further.

- Third-quarter earnings have begun, so there’s always the potential for a surprise on that front.

- Data will be scant this week. Monday will feature U.S. leading indicators, a generic health-of-the-economy type of stat. We’ll get nothing on Tuesday, and then we’ll get existing home sales and MBA mortgage applications on Wednesday.

- On Thursday, we’ll see unemployment claims, flash U.S. services, plus manufacturing PMI, which may give us some more insight into the inflation story and new home sales.

- Finally, durable goods data and consumer sentiment will be released on Friday.

Sources:

1 Lisa Kailai Han and Alex Harring. CNBC. Oct. 18, 2024. “Dow, S&P 500 close at record high and mark the year’s longest winning streak.” https://www.cnbc.com/2024/10/17/stock-market-today-live-updates.html. Accessed Oct. 21, 2024.

2 Yahoo! Finance. “Dow Jones Industrial Average (ˆDJI).” https://finance.yahoo.com/quote/%5EDJI/. Accessed Oct. 21, 2024.

3 Yahoo! Finance. “S&P 500 (ˆGSPC).” https://finance.yahoo.com/quote/%5EGSPC/. Accessed Oct. 21, 2024.

4 Yahoo! Finance. “NASDAQ Composite (ˆIXIC).” https://finance.yahoo.com/quote/%5EIXIC/. Accessed Oct. 21, 2024.

5 Debora Patta, Agnes Reau and Tucker Reals. CBS News. Oct. 21, 2024. “Israel’s war with Iran-backed Hezbollah escalates as IDF bombs financial institutions across Lebanon.” https://www.cbsnews.com/news/israel-war-iran-backed-hezbollah-idf-bombs-lebanon-civilians-displaced/. Accessed Oct. 21, 2024.

6 Warren Murray. The Guardian. Oct. 20, 2024. “Ukraine war briefing: Power cuts in Kharkiv after Russian strikes.” https://www.theguardian.com/world/2024/oct/21/ukraine-war-briefing-power-cuts-in-kharkiv-after-russian-strikes. Accessed Oct. 21, 2024.

7 Reuters. Oct. 21, 2024. “US, Canadian navies sail through Taiwan Strait week after war games.” https://www.reuters.com/world/asia-pacific/us-canadian-navies-sail-through-taiwan-strait-week-after-war-games-2024-10-20/. Accessed Oct. 21, 2024.

8 Yahoo! Finance. “CBOE Volatility Index (ˆVIX).” https://finance.yahoo.com/quote/%5EVIX/. Accessed Oct. 21, 2024.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/24 – 3916698-3

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.