Weekly Market Commentary

THE WEEK IN REVIEW: October 20, 2024 – October 26, 2024

Dude, where’s my rate cut?

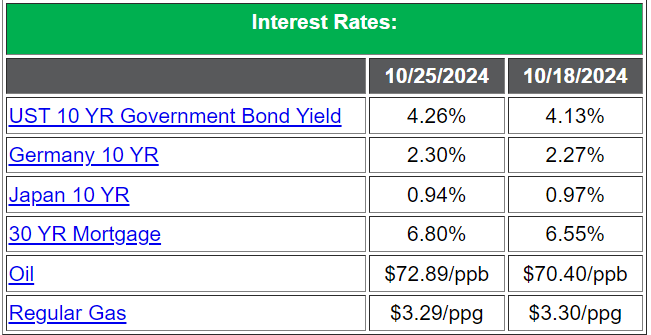

Just five weeks after the Federal Reserve’s jumbo rate cut of 50 basis points (0.50%), the 10-year Treasury yield has climbed from 3.74% to just below 4.25%. The 50-basis-point increase in market rates appears to have undone the Fed’s efforts.1

It’s paradoxical that as the Fed decided to begin lowering rates, the market headed in the opposite direction. 2 What does that tell us? Typically, uncertain environments require higher rates to make up for the perceived risks of tying up your money for longer time periods. It could be the market doesn’t believe we’ve tamed inflation yet and that it may reignite if the Fed doesn’t keep lowering rates at the initial pace as expected. This would force the Fed to pause or potentially reverse course, which would spook the markets and make the Fed look really foolish.

It all sounds extreme, but recent data (including economic growth and still-strong jobs) have pushed markets to change expectations of a 75-basis-point (0.75%) drop in short-term rates to a drop of 50 basis points over the next two Fed meetings in November and December. 3 That’s where the Fed has let us down; had they lowered by 25 basis points (0.25%) in July and another 25 in September we would be in the same place, but expectations wouldn’t have been raised as high as they were with the September jumbo cut.

If the Fed is forced to slow rate cuts because the economic data is still too strong and we don’t get cuts of 50 basis points by year-end, the market will likely pull back. If the rate decreases had been more measured, the Fed could have kept its options open and taken its time. But the jumbo rate cut raised expectations and markets ran with it, posting new highs as they continued to expect the same level of cuts going forward.

We still may end up in the same place, but how we get there is important. The chances of disappointment in the near term are greater, and we have a higher downside risk as we approach year-end. For the time being, it appears the Fed may have shot itself in the foot and lost the full impact of the initial rate cut.

Earnings are in full swing as elections take center stage

Third-quarter earnings have been generally good so far. There have been some notable winners, such as Netflix and Tesla.4,5 There have also been some stumbles; IBM, Honeywell and Starbucks were disappointing.6,7,8 Some troubles are self-inflicted; Boeing is in the midst of a machinist strike, which has knocked around 40% off the stock price for the year.9 Meanwhile, McDonald’s is having an E. coli problem, which kicked that stock around and took the markets down with it in the first part of last week.10

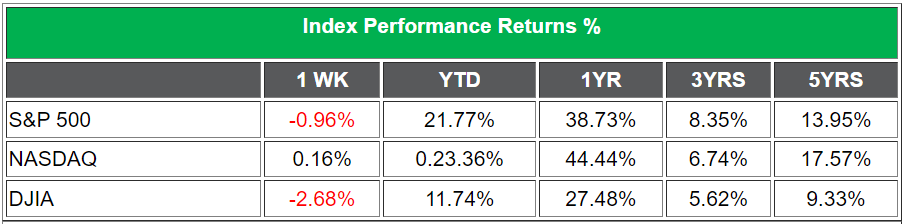

The election is just over one week away, so coverage will take up most of the oxygen in the room. However, we have some huge data due out this week, including gross domestic product (GDP), personal consumption expenditures (PCE) and the latest jobs numbers. Will the market get worse? Doubtful, despite all the handwringing last week. Don’t forget the kind of year equity markets are having; in fact, thanks to a well-behaved September, we’re on track for the best presidential election year returns in nearly 90 years.11 The turmoil has been real and painful at times, but investors who’ve remained focused and disciplined this year seem to have been rewarded handsomely so far.

Coming this week

- This week starts off pretty quietly with nothing reported on Monday, but that will quickly change with major data hitting all of the Big Three areas that impact markets (economic growth, jobs and inflation). We’ll also continue to see third-quarter earnings, which can move markets.

- On Tuesday, we’ll get the S&P Case-Schiller home price index and consumer confidence. We’ll also see the latest Job Openings and Labor Turnover Survey (JOLTS) report, which will include openings from September. The last reading was 8.04 million openings;12 we need to see this number decline, which would speak to a softening of the labor markets and keep the Fed on the path of easing rates.

- We’ll get the initial reading of third-quarter GDP on Wednesday. GDP grew at a 3% annual rate in the second quarter, and expectations are for 3.3% in the third.13,14 We’ll also get more jobs data with the ADP report, and again, we’re looking for weakness to keep the rate-cut dialogue on a positive track. Wednesday will also include inventory numbers and MBA mortgage applications, which will look at the condition of the real estate market.

- On Thursday, we’ll see unemployment claims, personal income and spending, and pending home sales. We’ll also get some inflation data with PCE and Core PCE (which excludes food and energy). Again, a lower number is better right now.

- Finally, a huge week of data will end with the Bureau of Labor Statistics (BLS) employment situation (aka the nonfarm payroll report) on Friday. The unemployment rate ticked down from 4.3% to 4.1% last month,15 which doesn’t bode well for Fed rate cuts if the job market stays solid. Here we’re looking for an increase in the number so the Fed can keep cutting rates.

Sources:

1 CNBC. “U.S. 10 Year Treasury.” https://www.cnbc.com/quotes/US10Y. Accessed Oct. 27, 2024.

2 Molly Grace. Business Insider. Oct. 24, 2024. “Today’s Mortgage Rates, October 24, 2024 | Why Did Rates Go Up After the Fed Cut?” https://www.businessinsider.com/todays-mortgage-rates-thursday-24-2024-10. Accessed Oct. 27, 2024.

3 CME Group. “FedWatch Tool.” https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Accessed Oct. 27, 2024.

4 Sarah Whitten. CNBC. Oct. 17, 2024. “Netflix third-quarter subscribers barely beat estimates as ad-tier members jump 35%.” https://www.cnbc.com/2024/10/17/netflix-nflx-earnings-q3-2024.html. Accessed Oct. 27, 2024.

5 Ari Levy and Lora Kolodny. CNBC. Oct. 25, 2024. “Tesla shares close at highest in 13 months as post-earnings rally continues.” https://www.cnbc.com/2024/10/25/tesla-shares-rise-to-highest-in-over-a-year-after-q3-earnings.html. Accessed Oct. 27, 2024.

6 IBM. Oct. 23, 2024. “IBM Releases Third-Quarter Results.” https://newsroom.ibm.com/2024-10-23-ibm-releases-third-quarter-results. Accessed Oct. 27, 2024.

7 Honeywell. Oct. 24, 2024. “Honeywell Reports Third Quarter Results; Updates 2024 Guidance.” https://www.honeywell.com/us/en/press/2024/10/honeywell-reports-third-quarter-results-updates-2024-guidance. Accessed Oct. 27, 2024.

8 Starbucks Stories & News. Oct. 22, 2024. “Starbucks Reports Preliminary Q4 and Full Fiscal Year 2024 Results.” https://stories.starbucks.com/press/2024/starbucks-reports-preliminary-q4-and-full-fiscal-year-2024-results/. Accessed Oct. 27, 2024.

9 Dominic Gates. The Seattle Times. Oct. 25, 2024. “As Machinists strike extends, Boeing is running out of runway.” https://www.seattletimes.com/business/boeing-aerospace/as-machinists-strike-extends-boeing-is-running-out-of-runway/. Accessed Oct. 27, 2024.

10 Jonel Aleccia. AP. Oct. 25, 2024. “At least 75 people are sickened as the deadly McDonald’s E. coli outbreak expands.” https://apnews.com/article/mcdonalds-e-coli-outbreak-quarter-pounder-a1ec3dc14636f5e713b15b32aedcd524. Accessed Oct. 27, 2024.

11 Frank Holmes. Forbes. Oct. 7, 2024. “U.S. Equities Surge In Best Election Year Since 1936.” https://www.forbes.com/sites/greatspeculations/2024/10/07/us-equities-surge-in-best-election-year-since-1936/. Accessed Oct. 27, 2024.

12 U.S. Bureau of Labor Statistics. “Job Openings and Labor Turnover Survey.” https://www.bls.gov/jlt/. Accessed Oct. 27, 2024.

13 Bureau of Economic Analysis. Sept. 26, 2024. “Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, Second Quarter 2024 and Annual Update.” https://www.bea.gov/data/gdp/gross-domestic-product. Accessed Oct. 27, 2024.

14 Federal Reserve Bank of Atlanta. “GDPNow.” https://www.atlantafed.org/cqer/research/gdpnow. Accessed Oct. 27, 2024.

15 Bureau of Labor Statistics. Oct. 4, 2024. “The Employment Situation – September 2024.” https://www.bls.gov/news.release/pdf/empsit.pdf. Accessed Oct. 27, 2024.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/24 – 3916698-4

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.