Weekly Market Commentary

THE WEEK IN REVIEW: October 27, 2024 – November 2, 2024

A wild ride to close out October

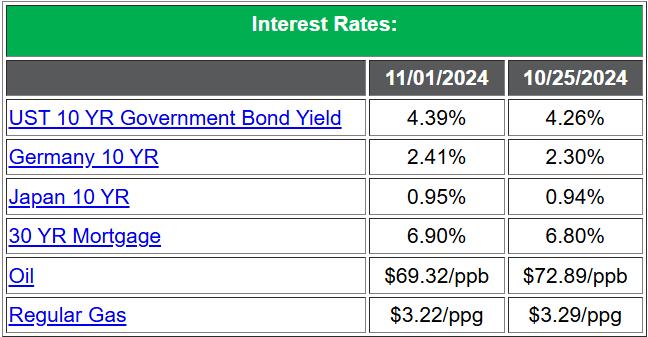

After nearly a month of waiting for Israel to respond to the Iranian missile attack on Oct. 1, the Israel Defense Forces (IDF) struck military installations in Iran,1 including military missile defense and production facilities. It was feared that Israel would strike Iran’s oil infrastructure (crippling Iran’s economy and disrupting global oil supplies) or even attack its nuclear development facilities. That didn’t happen; instead, the Israeli strike was precise, strategic and contained. Markets were relieved and oil prices and volatility both eased at the start of last week.2,3 However, new reports emerged that Iran was planning yet another direct attack on Israel,4 which sent oil back up to around $70 per barrel.

Markets also responded to some big data last week. The advance reading of third-quarter gross domestic product (GDP) clocked in at just under the 3% consensus year-over-year growth rate at 2.8%. 5 This signals a slowing economy, but is it soft enough of a reading for the Federal Reserve to continue to cut rates at the pace markets are expecting? Then there was the ADP number for October: It came in at +233,000 jobs when consensus was calling for +115,000 and expectations were for the reading to soften from last month’s reading of +143,000.6

We added more pieces to the puzzle as the week progressed. Personal consumption expenditures (PCE), the Fed’s preferred measure of inflation, came in at 2.1% year over year, down slightly from the prior month’s reading of 2.3%.7 Great news, right? Inflation is getting closer to the Fed’s target of 2%. The concern isn’t with PCE but with Core PCE, which excludes food and energy and came in at a rate of 2.7%. As we’ve mentioned before, both energy and food can be highly volatile, and if you strip those out, you’re left with prices stuck at an inflation rate closer to 3%. Core PCE has been hovering between 2.6%-2.9% since December 2023 and appears to be stalled at this point.

Finally, the Bureau of Labor Statistics (BLS) non-farm payroll report last Friday was really weak at +12,000, the worst reading since December 2020. 8 To be fair, the report was expected to be soft, given the hurricanes that hit the Southeast, the ongoing Boeing machinists’ strike and the three-day dockworkers strike at the beginning of October. However, one would think that was factored into the consensus number of 125,000.

The other sad nugget was that, while there were declines across the board, the government sector added 40,000 jobs in October. There were also all sorts of “adjustments,” with new jobs being revised downward for August and September by a total of 112,000. Meanwhile, the unemployment rate remained at 4.1%.9

The weak jobs report countered much of the stronger data we saw earlier in the week, putting the rate-cut discussion back on track. Right now, we’re seeing an extremely high likelihood of a 25-basis-point (0.25%) cut at the Fed meeting this week. 10

The other drama last week was when Meta11 (Facebook) and Microsoft12 delivered weak earnings and knocked markets into the negative column for October, snapping the S&P 500’s five-month winning streak. The markets sold off pretty hard on Thursday but rebounded on the weak jobs report and Amazon earnings on Friday, so at least November seems to be off to a good start.

What is the market telling us headed into the election?

Sectors and companies that would benefit from former President Trump’s policies and the stated desire to cut regulatory red tape (such as energy, defense and Russell 2000 small caps) have all done well recently. At the same time, despite the Fed’s September jumbo rate cut, rates haven’t declined but actually rose, partly because economic data isn’t supportive of additional cuts. As mentioned in the section above, inflation has yet to be tamed; the economy is still strong, and job growth has been solid. The Bureau of Labor Statistics non-farms report could likely be an anomaly, but jobs may finally be rolling over. This doesn’t bode well for a “continuation of accommodative monetary policy,” which is a fancy way of saying we shouldn’t expect more rate cuts.

Headed into this week, there may be a disconnect between what the market is wishing for and what the Fed will actually do; we may very well see a quarter-point rate cut this week and nothing in December. As for the election, many financial policy questions still linger. Neither candidate has expressed any willingness to address deficit spending or our huge debt burden. In fact, debt service is the third-highest item13 in the federal budget, and with rates at current levels, it appears interest payments will only increase going forward. There has been some discussion from Trump about cutting government waste and making government efficient, but nothing concrete, and frankly, good luck with that.

All this makes for a rich and colorful backdrop for Tuesday’s elections. Regardless of the outcome, markets will find a way — they always do.

Coming This Week

- The election and the Fed meeting are likely to dominate headlines and markets this week.

- There is a chance that we may not know the winner of the presidential election on Tuesday. It all depends on how quickly the vote can be tabulated and results announced. Many states have different methods for how votes are counted and reported, so if the election is close (as expected), we could experience a delay, which may cause market turbulence.

- The Fed will meet on Wednesday, and they’re expected to give a rate-cut decision on Thursday. Right now, the probability is pointing to a 25-basis-point (0.25%) cut. Given the strong economic data, continued rate cuts will stoke inflationary worries. In fact, the recent backup in yields (as evidenced by the 10-year Treasury at 4.3%) is telling us the bond markets aren’t convinced that inflation won’t return.

- As for the rest of the week, we’ll see factory orders (Monday), the trade deficit (Tuesday), MBA mortgage applications (Wednesday), weekly unemployment claims (Thursday) and consumer sentiment (Friday).

- Earnings will continue throughout the week and can influence markets at any time. This week, 104 S&P 500 and 24 Nasdaq 100 companies will report. As of Oct. 25, 37% of the S&P 500 had reported actual results, with three-quarters reporting positive earnings per share (EPS) and 59% reporting positive revenues.14 Earnings growth for the third quarter for the S&P 500 is 3.6%, the fifth straight year-over-year earnings growth for the index. For the current quarter, 20 S&P 500 companies have issued negative EPS guidance, and 11 companies have issued positive EPS guidance, more bad than good. Valuation is still rich for the S&P 500, with the forward 12-month price-to-earnings (P/E) ratio at 21.7 versus the 5-year average (19.6) and 10-year average (18.1).

Sources:

Sources:

1 Freddie Clayton and Mithil Aggarwal. NBC News. Oct. 29, 2024. “Satellite images show damage at Iran military sites after Israel attack.” https://www.nbcnews.com/news/world/satellite-images-show-damage-iran-military-sites-israel-attack-rcna177552. Accessed Nov. 3, 2024.

2 Markets Insider. “Oil (WTI).” https://markets.businessinsider.com/commodities/oil-price?type=wti. Accessed Nov. 3, 2024.

3 Yahoo! Finance. “CBOE Volatility Index (ˆVIX).” https://finance.yahoo.com/quote/%5EVIX/. Accessed Nov. 3, 2024.

4 Vasco Cotovio and Sophie Tanno. CNN. Nov. 2, 2024. “Iran’s supreme leader vows ‘teeth-breaking’ response to Israel and US after strikes on military sites.” https://www.cnn.com/2024/11/02/middleeast/iran-supreme-leader-response-israel-intl/index.html. Accessed Nov. 3, 2024.

5 Bureau of Economic Analysis. Oct. 30, 2024. “Gross Domestic Product, Third Quarter 2024 (Advance Estimate).” https://www.bea.gov/news/2024/gross-domestic-product-third-quarter-2024-advance-estimate. Accessed Nov. 3, 2024.

6 ADP Research. October 2024. “ADP® National Employment Report.” https://adpemploymentreport.com/. Accessed Nov. 3, 2024.

7 Bureau of Economic Analysis. Oct. 31, 2024. “Personal Consumption Expenditures Price Index.” https://www.bea.gov/data/personal-consumption-expenditures-price-index. Accessed Nov. 3, 2024.

8,9 U.S. Bureau of Labor Statistics. Nov. 1, 2024. “Employment Situation Summary.” https://www.bls.gov/news.release/empsit.nr0.htm. Accessed Nov. 3, 2024.

10 CME Group. “FedWatch.” https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Accessed Nov. 3, 2024.

11 Meta Investor Relations. Oct. 30, 2024. “Meta Reports Third Quarter 2024 Results.” https://investor.fb.com/investor-news/press-release-details/2024/Meta-Reports-Third-Quarter-2024-Results/default.aspx. Accessed Nov. 3, 2024.

12 Dallas Express. Nov. 1, 2024. “Microsoft Stock Stumbles Despite Record-Breaking Quarterly Earnings.” https://dallasexpress.com/business-markets/microsoft-stock-stumbles-despite-record-breaking-quarterly-earnings/. Accessed Nov. 3, 2024.

13 Peter G. Peterson Foundation. Aug. 6, 2024. “What is the National Debt Costing Us?” https://www.pgpf.org/blog/2024/08/what-is-the-national-debt-costing-us. Accessed Nov. 3, 2024.

14 John Butters. Factset. Oct. 25, 2024. “Earnings Insight.” https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_102524.pdf. Accessed Nov. 4, 2024.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/24 – 3916698-4

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.