Weekly Market Commentary

THE WEEK IN REVIEW: November 3, 2024 – November 9, 2024

What a week.

November has been a whirlwind so far — and we’re not even halfway through. The first week of the month brought lots of big data, including third-quarter gross domestic product (GDP), the latest inflation report and updated jobs numbers. But all that seemed to pale in comparison to the market movers last week.

First up: the election. Former President Donald Trump completed his political comeback and secured the election over current Vice President Kamala Harris on Tuesday.1 Some thought results would take several days to sort out, but the election was called early Wednesday morning as it became evident Trump had the votes.

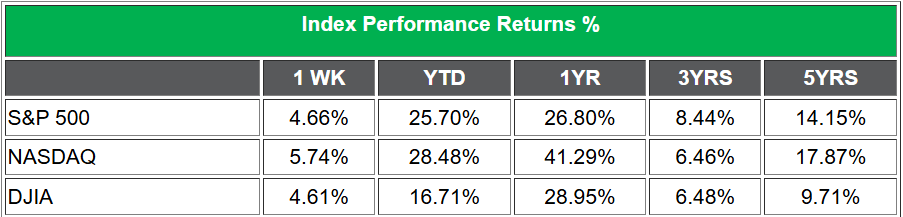

The stock market soared on Wednesday to set a record for the best post-election day results.2 Most of the major benchmarks rose to record highs last week, as traders seemed to consider the next four years under a Republican administration and the possibility of faster earnings growth, lower regulations and lower corporate taxes. The S&P 500’s 4.66% gain was its best weekly jump since November of last year, while the Russell 2000 surged 8.57% for the week.3,4

Markets probably jumped because of one primary reason: The uncertainty about policies (at least for the next four years) somewhat goes away. The consensus is that Trump’s second presidency will bring restricted immigration and increased tariffs, both of which carry inflationary implications. However, it’s unknown how those measures will be implemented and how long it could take. Meanwhile, a stronger U.S. dollar might offset some impact from tariffs, while lower taxes and deregulatory initiatives could help support the economy.

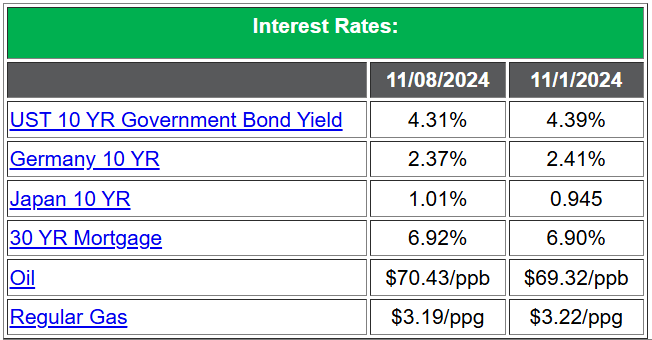

After all the “what will they do?” speculating, the Federal Reserve’s meeting was pretty much a footnote in the shadow of the election. The Fed announced another rate cut on Thursday, this one coming in at 25 basis points (0.25%).5 There had been some speculation as to whether Fed Chair Jerome Powell would mention the president-elect’s fiscal policy and its potential impact on monetary policy. However, Powell noted that the Fed would continue to evaluate changes as they were announced and also stated that he would not resign if asked to do so by the incoming president.6

Powell did acknowledge that inflation remains higher than their 2% target in his remarks. In addition, the Institute for Supply Management’s (ISM) Services index — a gauge of demand in the services industry — came in at 56%, indicating expansion in that sector.7 (A reading of more than 50 indicates expansion, while below 50 indicates contraction.) This, plus the inflation and jobs data we saw last week, means we probably should take previous expectations for rate cuts and throw them away. The data is a moving target — and the Fed’s future moves are, as well.

Coming This Week

- The bond market is closed on Monday for Veterans Day.

- Fed officials will be making the rounds all week. What will they have to say about another potential rate cut in December?

- We’ll see the latest Consumer Price Index (CPI) and Core CPI numbers on Wednesday. The Producer Price Index (PPI) and Core PPI will follow on Thursday. The Fed will be watching them closely to see if the numbers tick down.

- The week will conclude with a flurry of data on Friday, including import prices, retail sales, industrial production and business inventories.

Sources:

1 NBC News. Nov. 10, 2024. “2024 President Results: Trump wins.” https://www.nbcnews.com/politics/2024-elections/president-results. Accessed Nov. 10, 2024.

2 Rita Nazareth. Yahoo! Finance. Nov. 6, 2024. “S&P 500 Sees Best Post-Election Day in Its History: Markets Wrap.” https://finance.yahoo.com/news/asian-stocks-echo-us-gains-233114263.html. Accessed Nov. 10, 2024.

3 Medora Lee. USA Today. Nov. 10, 2024. “Stocks rally again. Dow and S&P 500 see best week this year after big Republican win.” https://www.usatoday.com/story/money/personalfinance/2024/11/08/stocks-best-week-trump-win/76132281007/. Accessed Nov. 10, 2024.

4 Yahoo! Finance. “Russell 2000 (ˆRUT).” https://finance.yahoo.com/quote/%5ERUT/. Accessed Nov. 10, 2024.

5 Jeff Cox. CNBC. Nov. 7, 2024. “Federal Reserve cuts interest rates by a quarter point.” https://www.cnbc.com/2024/11/07/fed-rate-decision-november-2024.html. Accessed Nov. 10, 2024.

6 Tim Smart. U.S. News & World Report. Nov. 7, 2024. “Fed Cuts Interest Rates Again, Powell Says He Won’t Resign if Trump Asks.” https://www.usnews.com/news/economy/articles/2024-11-07/fed-cuts-interest-rates-again-powell-says-he-wont-resign-if-trump-asks. Accessed Nov. 10, 2024.

7 Institute for Supply Management. “Report on Business: Services.” https://www.ismworld.org/globalassets/pub/research-and-surveys/rob/nmi/b3strob202411svcs.pdf. Accessed Nov. 10, 2024.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

11/24 – 3991358-2

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.