Weekly Market Commentary

THE WEEK IN REVIEW: October 6, 2024 – October 12, 2024

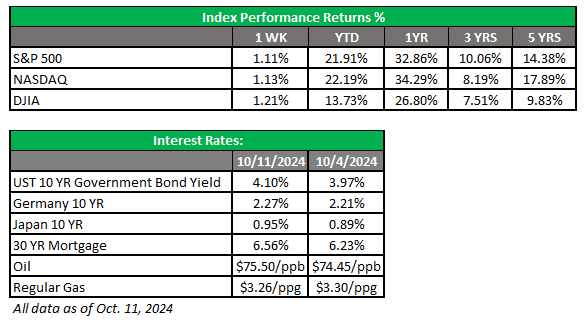

Another week, another record high

The S&P 500 hit a new all-time high last week, the 45th time it’s done that in 2024.1 The Dow also saw a new high, after the earnings season kicked off in a positive way.2 Banks like JPMorgan Chase and Wells Fargo reported less-than-expected profit declines in the third quarter, offsetting several disappointing economic reports.3

One area of disappointment was inflation, which ticked up by 0.2% in September. (Core inflation — which excludes food and energy — rose 0.3%.) Inflation is still at a three-year low, but it’s cooling more slowly than expected. Core prices also increased 3.3% year-over-year in September versus 3.2% in August.4

Weekly jobless claims came in at 258,000, the highest level in 14 months.5 Many of these jobless claims were due to hurricane closures in the southeastern part of the U.S., so some of those jobs may come back as clean-up continues. Still, the jobless claims plus the uptick in inflation changed expectations for the Federal Reserve’s meeting next month, with futures markets pricing in a decent chance of the Fed shying away from another cut and keeping rates steady instead.6

The minutes from the Fed’s last meeting, released last week, revealed why they chose a jumbo cut of 50 basis points (0.50%) instead of the expected cut of 25 basis points (0.25%).7 Based on the minutes, Fed officials were divided over what to do, with several favoring the smaller cut. It seems unlikely that we’ll see another jumbo cut this year.

Breaking up is hard to do

The Department of Justice is once again coming after Google. Reports came out last week that the department is considering asking a federal judge to order the company’s breakup, saying its products such as Chrome, Play and Android force users to Google Search and therefore create a monopoly.8 No decision has been made yet, but the news pushed Google parent Alphabet’s stocks down last week. Tesla also had a shaky week following a lukewarm response to its new “robotaxis” and “robovans.”9 Fortunately, NVIDIA once again saw their shares rise, keeping tech-heavy indexes steady for the week.10

Coming This Week

- The bond market is closed on Monday for Columbus Day.

- Fed Governors Christopher Waller and Adriana Kugler are scheduled to speak this week. Perhaps they’ll shed additional light on the Fed’s thinking headed into their November meeting.

- Data this week is relatively scant. We’ll see import prices on Wednesday, followed by retail sales, industrial production and the Philadelphia Fed manufacturing index on Thursday.

- Friday will include housing starts and building permits, giving us insight into the state of the housing market.

Sources:

1 Yahoo! Finance. “S&P 500 (ˆGSPC).” https://finance.yahoo.com/quote/%5EGSPC/. Accessed Oct. 14, 2024.

2 Yahoo! Finance. “Dow Jones Industrial Average (ˆDJI).” https://finance.yahoo.com/quote/%5EDJI/. Accessed Oct. 14, 2024.

3 Harrison Miller. Investor’s Business Daily. Oct. 11, 2024. “JPMorgan, Wells Fargo, BlackRock, BNY Score Strong Earnings Beats.” https://www.investors.com/news/jpmorgan-jpm-stock-bank-earnings-wells-fargo-wfc-blackrock/. Accessed Oct. 14, 2024.

4 Lucia Mutikani. Reuters. Oct. 11, 2024. “US producer prices flat; higher monthly core inflation expected in September.” https://www.reuters.com/markets/us/us-producer-prices-unchanged-september-2024-10-11/. Accessed Oct. 14, 2024.

5 Reuters. Oct. 10, 2024. “US weekly jobless claims surge amid Hurricane Helene distortions.” https://www.reuters.com/markets/us/us-weekly-jobless-claims-surge-amid-hurricane-helene-distortions-2024-10-10/. Accessed Oct. 14, 2024.

6 CME Group. “FedWatch.” https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Accessed Oct. 14, 2024.

7 FederalReserve.gov. “Minutes of the Federal Open Market Committee: September 17-18, 2024.” https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20240918.pdf. Accessed Oct. 14, 2024.

8 Jody Godoy. Reuters. Oct. 9, 2024. “US considers breakup of Google in landmark search case.” https://www.reuters.com/technology/us-propose-how-google-should-boost-online-search-competition-2024-10-08/. Accessed Oct. 14, 2024.

9 Seana Smith. Yahoo! Finance. Oct. 14, 2024. “Tesla stock selloff after robotaxi event could be just the beginning, pros warn.” https://finance.yahoo.com/news/tesla-stock-selloff-after-robotaxi-event-could-be-just-the-beginning-pros-warn-155630131.html. Accessed Oct. 14, 2024.

10 Vidya Ramakrishnan. Investor’s Business Daily. Oct. 11, 2024. “Nvidia Edges Higher After Execs Say Blackwell Chip Sold Out, Two Issues Ironed Out; Is Nvidia A Buy Now?” https://www.investors.com/research/nvda-stock-is-nvidia-a-buy-2/. Accessed Oct. 14, 2024.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

10/24 – 3916698-2

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.