Weekly Market Commentary

THE WEEK IN REVIEW: February 2, 2025 – February 8, 2025

|

Tariff turbulence |

|

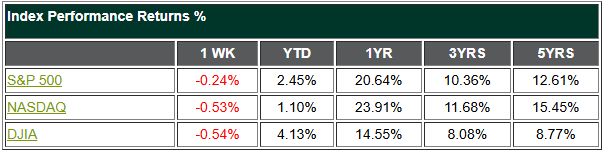

As promised during the campaign, President Trump announced tariffs on Canada, China and Mexico.1 The move was meant to pressure the countries to help with the border (in the case of Mexico and Canada) and stop the flow of fentanyl into the U.S. (all three). The move was announced on Friday, Jan. 31, and was set to take effect on Saturday, Feb. 1. Predictably, the markets tanked, wiping out gains on the last day of the month but still notching a pretty solid start to the year despite all the frothiness. Then Monday started off ugly with futures plunging 800 on the Dow.2 That same day, Trump agreed to put Mexico’s tariffs on hold for a month after a “very friendly conversation” with the Mexican president, then did the same with Canada after they agreed to concessions as well.3 Markets wiped out earlier losses after the announcement of the delay, and by Tuesday the markets were close to the same levels they were at before all the tariff turbulence began. As for China, there was much talk about whether Trump and Chinese President Xi Jinping will be talking soon.4 Trump’s approach to China does not seem as blunt as he was with our two neighbors; it even appears a bit nuanced, as he exempted small packages from China which are a large part of the shipments made to the U.S. from companies like Temu and Shein.5 However, a lot of the tariffs imposed on China during the first Trump administration were never removed, so it’s a little more complicated. Markets were nearly back to record levels by the end of Thursday — but the January jobs numbers, consumer sentiment and more tariff talk made for a tough end to the week. |

|

Jobs, the consumer and more tariffs |

|

Last week’s data was all about jobs. The Job Openings and Labor Turnover Survey (JOLTS) report was released on Tuesday, with openings dropping from 8.16 million in November to 7.6 million in December.6 Then on Wednesday, the ADP employment report surprised to the upside, with +183,000 private sector jobs reported versus the forecast of +153,000.7 The prior month’s reading was also revised upward significantly from +122,000 to +176,000. The report showed jobs were still growing but openings were slowing — not a bad place to be. The Bureau of Labor Statistics (BLS) employment situation (aka non-farms payroll) for January came in at +143,000, under the consensus of +168,000. The report for December was revised upward from +256,000 to +307,000. However, the report also showed 598,000 fewer jobs were created in the last 12 months than previously estimated. Meanwhile, the unemployment rate dipped from 4.1% to 4.0%.8 Markets didn’t care for the “meh” jobs number, which wasn’t bad enough to convince anyone that the Fed may accelerate rate cuts. The dip in consumer sentiment to a seven-month low also soured markets.9 Finally, President Trump said there will be more tariffs on other countries that he plans to announce this week — and that was enough to sink the markets on Friday. All that activity and bluster led to a down week across the board for markets, but the levels were about in line with where we finished the week prior. Let’s hope there is a master plan here, because the week we just had in the markets is exhausting. |

|

Coming this week |

|

Sources

1 White House. Feb. 1, 2025. “Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China.” https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/. Accessed Feb. 10, 2025.

2 CNBC. “Dow Jones Industrial Average.” https://www.cnbc.com/quotes/.DJI. Accessed Feb. 10, 2025.

3 Josh Boak, Fabiola Sánchez and Rob Gillies. AP. Feb. 3, 2025. “Trump agrees to pause tariffs on Canada and Mexico after they pledge to boost border enforcement.” https://apnews.com/article/trump-tariffs-canada-mexico-china-sheinbaum-trudeau-017efa8c3343b8d2a9444f7e65356ae9. Accessed Feb. 10, 2025.

4 Ari Hawkins. Politico. Feb. 4, 2025. “Trump in ‘no rush’ to talk to Chinese leader.” https://www.politico.com/news/2025/02/04/trump-china-trade-tariff-xi-00002357. Accessed Feb. 10, 2025.

5 Natalie Sherman. BBC. Feb. 7, 2025. “Trump suspends tariffs on small packages from China.” https://www.bbc.com/news/articles/c5y7edy35pvo. Accessed Feb. 10, 2025.

6 U.S. Bureau of Labor Statistics. Feb. 4, 2025. “Job Openings and Labor Turnover Summary.” https://www.bls.gov/news.release/jolts.nr0.htm. Accessed Feb. 10, 2025.

7 ADP Research. January 2025. “ADP® National Employment Report.” https://adpemploymentreport.com/. Accessed Feb. 10, 2025.

8 U.S. Bureau of Labor Statistics. Feb. 7, 2025. “Employment Situation Summary.” https://www.bls.gov/news.release/empsit.nr0.htm. Accessed Feb. 10, 2025.

9 Courtenay Brown. Axios. Feb. 7, 2025. “Tariff fears sink consumer economic mood in February.” https://www.axios.com/2025/02/07/consumer-sentiment-trump-tariffs. Accessed Feb. 10, 2025.

10 U.S. Bureau of Labor Statistics. Jan. 15, 2025. “Consumer Price Index Summary.” https://www.bls.gov/news.release/cpi.nr0.htm. Accessed Feb. 10, 2025.

11 U.S. Bureau of Labor Statistics. Jan. 14, 2025. “Producer Price Index News Release Summary.” https://www.bls.gov/news.release/ppi.nr0.htm. Accessed Feb. 10, 2025.

12 John Butters. FactSet. Feb. 7, 2025. “Earnings Insight.” https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_020725A.pdf. Accessed Feb. 10, 2025.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.