Weekly Market Commentary

THE WEEK IN REVIEW: February 9, 2025 – February 15, 2025

|

Inflation worries to join tariffs as a source of concern — it’s more than just eggs! |

|

In the past few weeks, there has been a tug-of-war between fears of what tariffs may do to the U.S. economy’s growth prospects versus strong fourth-quarter 2024 earnings. Both have been battling for the upper hand — and now inflation has joined the conversation. To be fair, inflation was never really out of the conversation, given that it’s been stuck around 3% for about a year and has dominated Federal Reserve policy. Plus, it’s been giving the market fits about when — if ever — we’ll see inflation come down further.1 Well, it’s not coming down yet. The Consumer Price Index (CPI), the most widely followed measure of inflation, surprised everyone last Wednesday by coming in at +0.5% for January versus consensus expectations of +0.3%. The means year-over-year inflation is running at 3%, pretty much back to the 3.1% we saw in January 2024.2 Obviously, that’s not progress. Core inflation, which attempts to smooth out some of the volatility by removing food and energy prices, was also elevated. It came in at +0.4% for January, also higher than the consensus expectations of 0.3%. That year-over-year number inched up from 3.2% to 3.3%.3 It appears that inflation is stuck at best and going higher at worst. Sure, energy, food and rent prices were higher — but even if you strip all that out into what the Fed calls its “SuperCore,” the reality is that prices surged 0.8% in January.4 Ironically, food, energy and rents, although elevated, actually worked to make the overall inflation number milder than it could have been. The increases are everywhere: airline fares, hotel rates, motor vehicle insurance, used cars, etc. The Producer Price Index (PPI) was no better the following day. Expectations were calling for +0.3% for January, while the actual number was +0.4%. This translated into a year-over-year PPI rate of 3.5%, up from the prior reading of 3.3%. Interestingly, December PPI was revised from +3.3% to +3.5%, so one could argue that PPI remained steady and that’s why markets didn’t react negatively to the reading. The cost to produce goods is still high, and it appears producers are starting to pass those costs on to the consumer. It makes sense, as producers cannot absorb higher costs indefinitely. So we have another guest at the volatility party. Markets have been wound up over tariffs and their possible impact on the economy. Now, we’ll have to deal with actual inflation and not just the potential for higher prices due to tariffs. On a brighter note, fourth-quarter 2024 earnings have been pretty good so far and have pulled the markets out of a panicked nosedive each time tariff fears have sprung up. With inflation stuck at its current level and the unknown impacts of tariffs on the consumer, the market is beginning to realize no help will be coming from the Fed via interest rate cuts (more below). As a result, markets will likely be walking on very expensive eggshells for the next few months. |

|

The final 1% remains elusive at the congressional hearings |

|

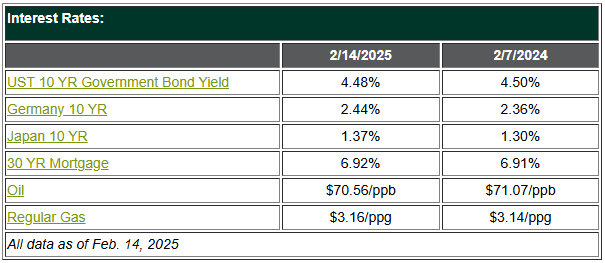

Fed Chair Jerome Powell presented to both chambers of Congress last week on the state of the U.S. economy.5 This report used to be called the Humphrey-Hawkins testimony (in honor of the two lawmakers who were the lead sponsors of the act establishing the requirement). The actual law passed in 1978 was called “The Full Employment and Balanced Growth Act of 1978” and mandates that the Fed chair submit a report and testify before Congress twice a year. This was where the Fed picked up its second mandate of full employment in addition to price stability.6 Enough history; let’s cut to the chase. Powell said the economy remains “strong” and job growth remains “solid” in his report. He also said we need to wait for inflation to come down before the Fed cuts interest rates again. The statement caused markets to shudder a bit, as they were pricing in two rate cuts in 2025 starting in June. But the narrative appears to be unraveling, and the first cut is now projected to happen in September at the earliest. That might as well be 20 years from now; the way we’ve seen markets move so far this year, six or seven months is an eternity. With inflation where it is, it would be the height of irresponsibility to cut rates further. In fact, if the Fed wants to get back into the conversation, we should be talking about potential rate increases, not cuts. But the Fed doesn’t have the stomach for that right now. And despite all the bluster and cajoling from President Trump to lower rates, the Fed will stay put. That leaves two options to consider on the path to lower rates: 1) a recession will force the Fed to move, which right now appears unlikely; or 2) we’ll see a significant reduction in energy costs and government regulation, which will be durable enough to allow producers to cut prices or at least stop increasing them. It’s too early to tell on that option. With rates where they currently are, we probably won’t see inflation come down from the 3% level for a while. |

|

Coming this week |

|

Sources

1 US Inflation Calculator. “Current US Inflation Rates: 2000-2025.” https://www.usinflationcalculator.com/inflation/current-inflation-rates/. Accessed Feb. 17, 2025.

2 U.S. Bureau of Labor Statistics. Feb. 12, 2025. “Consumer Price Index Summary.” https://www.bls.gov/news.release/cpi.nr0.htm. Accessed Feb. 17, 2025.

3 Christopher J. Neely. Federal Reserve Bank of St. Louis. May 3, 2024. “Measuring Inflation: Headline, Core and “Supercore” Services.” https://www.stlouisfed.org/on-the-economy/2024/may/measuring-inflation-headline-core-supercore-services. Accessed Feb. 17, 2025.

4 U.S. Bureau of Labor Statistics. Feb. 13, 2025. “Producer Price Index News Release Summary.” https://www.bls.gov/news.release/ppi.nr0.htm. Accessed Feb. 17, 2025.

5 Bryan Mena. CNN. Feb. 11, 2025. “Key takeaways from Fed Chair Jerome Powell’s congressional hearing.” https://www.cnn.com/2025/02/11/economy/fed-chair-powell-senate-testimony/index.html. Accessed Feb. 17, 2025.

6 Aaron Steelman. Federal Reserve History. “Full Employment and Balanced Growth Act of 1978 (Humphrey-Hawkins).” https://www.federalreservehistory.org/essays/humphrey-hawkins-act. Accessed Feb. 17, 2025.

7 John Butters. FactSet. Feb. 14, 2025. “Earnings Insight.” https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_021425.pdf. Accessed Feb. 17, 2025.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.