Weekly Market Commentary

THE WEEK IN REVIEW: March 9, 2025 – March 15, 2025

Correction time

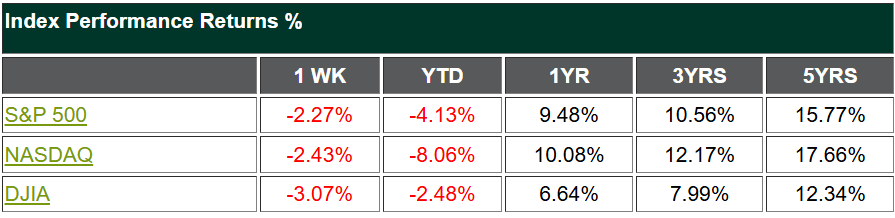

Less than one month after hitting a new record high earlier in the first quarter, the S&P 500 entered correction territory last week.1 It has noted four consecutive weeks of negative returns, along with the Nasdaq and Russell 2000.2,3 The Dow has also stumbled significantly, and all four indexes are in negative territory for the year.4

Trade policy and tariffs drove much of the negative sentiment and fueled ongoing uncertainty for markets. Consumer sentiment is also declining under the weight of growth concerns and fears of an impending recession.5 These fears weren’t helped when President Trump said the U.S. economy is in a “period of transition” last week.6 Sentiment declined 11% month-over-month and is now down 22% in three months. The report stated consumer expectations “deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions and stock markets.”

While the pullback and recession fears are concerning, we must keep things in perspective. The Dow, Nasdaq and S&P 500 all hit record highs in the past six months, and the latter two both added double-digit returns in 2024. A correction is not entirely unexpected and likely overdue.

One good piece of news from last week: The consumer price index (CPI) indicated consumer prices rose 0.2% from January to February.7 Core CPI, which excludes food and energy, rose 3.1% in the past 12 months, its lowest year-over-year increase since early 2021. Both readings were down from January and slightly below consensus expectations. The producer price index (PPI) data was similar, with Core PPI prices declining for the first time since July 2024.8

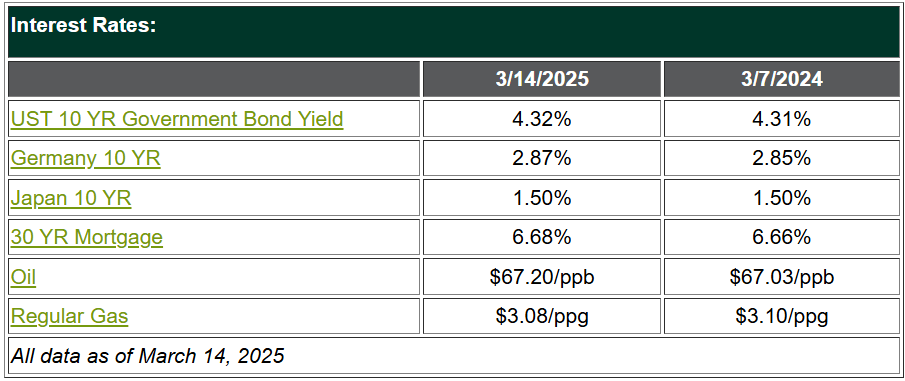

This inflation data seemed to help alleviate some concerns about the U.S. economy, although it didn’t do much to keep markets from sliding last week. What it did do, however, is reignite talk about three or four interest rate cuts this year, up from the previously projected one or two. The Federal Reserve is scheduled to meet on Tuesday and Wednesday this week; while they aren’t expected to make cuts this month, Chairman Jerome Powell’s post-meeting comments should give us more clarity on if and when cuts might happen.9

However, economic concerns still persist and will likely rattle markets for a bit longer. We know it’s difficult to watch market volatility rise after a duration of relative calm. If you’re concerned about your investments, we urge you to reach out to your financial advisor. Review your risk and reallocate if needed. Lean on them to help you make logic-based — not emotion-based — decisions. Above all, keep your eyes focused on the long term. Market corrections come, but they also go, and investors who are patient are typically rewarded in the end.

Coming this week

- The Fed will meet on Tuesday and Wednesday. Any indication that they’re considering rate cuts sooner rather than later could be good for markets.

- Data this week will kick off with U.S. retail sales, business inventories and the home builder confidence index on Monday. We’ll also get housing starts, building permits, import prices and industrial production on Tuesday. Thursday will feature initial jobless claims, the Philadelphia Fed manufacturing survey, existing home sales and leading economic indicators.

Sources:

1 Karen Friar, Ines Ferré and Josh Schafer. Yahoo! Finance. March 13, 2025. “Stock market today: S&P 500 enters correction, Dow sinks 500 points amid Trump’s latest tariff threats.” https://finance.yahoo.com/news/live/stock-market-today-sp-500-enters-correction-dow-sinks-500-points-amid-trumps-latest-tariff-threats-200508550.html. Accessed March 17, 2025.

2 Yahoo! Finance. “NASDAQ Composite (ˆIXIC).” https://finance.yahoo.com/quote/%5EIXIC/. Accessed March 17, 2025.

3 Yahoo! Finance. “Russell 2000 (ˆRUT).” https://finance.yahoo.com/quote/%5ERUT/. Accessed March 17, 2025.

4 Yahoo! Finance. “Dow Jones Industrial Average (ˆDJI).” https://finance.yahoo.com/quote/%5EDJI/. Accessed March 17, 2025.

5 Jeff Cox. CNBC. March 14, 2025. “Consumer sentiment slumps in March to lowest since 2022 as Trump tariffs spark more inflation worries.” https://www.cnbc.com/2025/03/14/university-of-michigan-consumer-sentiment-survey-drops-in-march-to-57point9-worse-than-expected.html. Accessed March 17, 2025.

6 NPR. March 14, 2025. “Trump says the economy is in ‘transition.’ What comes after?” https://www.npr.org/2025/03/14/1238535916/trump-economy-transition-tariffs-stock-market-correction. Accessed March 17, 2025.

7 U.S. Bureau of Labor Statistics. March 12, 2025. “Consumer Price Index Summary.” https://www.bls.gov/news.release/cpi.nr0.htm. Accessed March 17, 2025.

8 U.S. Bureau of Labor Statistics. March 13, 2025. “Producer Price Index News Release summary.” https://www.bls.gov/news.release/ppi.nr0.htm. Accessed March 17, 2025.

9 CME Group. “FedWatch.” https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Accessed March 17, 2025.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

3/25 – 4283499-3

Ready to Take

The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.