Weekly Market Commentary

THE WEEK IN REVIEW: April 6, 2025 – April 12, 2025

Tariff battle evolves

The market volatility continued last week but began to take shape as a showdown between the U.S. and China instead of the U.S. against the entire world.1 There was a false report on Monday that the administration was considering a 90-day pause in the implementation of tariffs announced the prior week during President Trump’s “Liberation Day” Rose Garden ceremony. That erroneous report reversed a steep plunge on Monday and markets spiked to positive territory before ultimately tailing off.

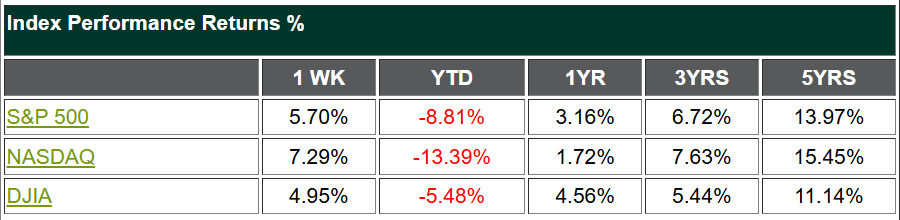

The interesting thing was that Monday’s “fake news” turned out to be true. On Wednesday, the president announced a 90-day pause for everyone on his “naughty” list except China.2 Instead, the administration doubled down on China with more metaphorical lumps of coal by raising the tariffs to 145%.3 The 90-day tariff pause led to a furious rally on Wednesday, resulting in the second-best day ever for the Nasdaq (+12.16%) and the third-best day for the S&P 500 since 1957 (+9.52%).4,5

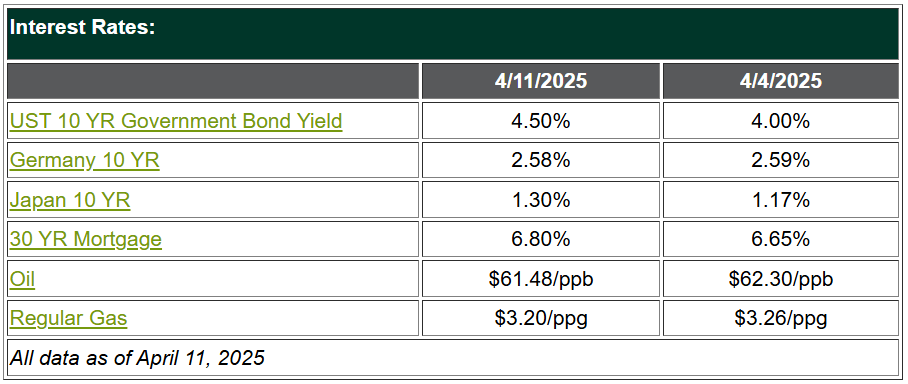

This market is dancing to its own tune. The recent jobs and inflation data has been positive, and Trump’s “big beautiful bill” with tax and budget cuts is moving along.6 Still, markets don’t care right now. The issues currently plaguing the markets are that bond yields continue to climb, which isn’t a positive signal, and yet the market is expecting the Federal Reserve to cut rates up to five times this year.7 Something has to give.

Typically, during equity market sell-offs, government bond yields drop as people pile into those assets for safety — but not this time. The dollar is sinking on debt and deficit fears. The volatility index (VIX) has pulled back from a five-year high in the 50s but is still in the mid-40s (a huge red flag) after spending most of the past year in the teens, with brief exceptions in August and December.8

The market is so volatile right now that Goldman Sachs, the “smartest people on Wall Street,” have had their brains broken by all the recent activity. First, they called for a recession early last week, then after Wednesday’s big rally, they pulled back their recession call.9

So, where does that leave us? It seems like this tariff deal has always been about a showdown with China. In 90 days, we will likely have made deals with most of the world, and the “tariff tsunami” in the markets will have passed. The wild card is how things play out with China and how much progress is made. Right now, things are moving in the wrong direction on that front.

Reality vs. perception

Are we actually in a recession right now? Never mind the J.P. Morgan and Goldman Sachs predictions and probabilities — what does a “45% recession” look like anyway?10 Either it’s a thing, or it’s not.

The country’s mood has soured over the past few weeks so much that it seems we’ve willed ourselves into a recession, at least emotionally and mentally. We keep hearing about “soft data” and that consumer confidence and consumer sentiment are bad. But we have yet to see an official recession in the hard data like job declines or negative gross domestic product (GDP) readings.

Ever heard of a self-fulfilling prophecy? If you believe something bad will happen, it will. So, here’s where we are: We have strong job numbers, energy prices are down, and inflation has declined two months in a row, and producer prices are down as well.11,12 We’re going to get tax cuts and a reduction in government spending. But all we hear about is tariffs and how devastating they will be. Or that the immense pain of cutting a budget that has grown immensely since the pandemic will be too hard to bear.

Our view is to not let the propensity of negative news manipulate us into feeling worse, but that’s what happened as we closed out the week with consumer sentiment tanking. Markets bounced around on Friday, but the movements were much more muted as we ended a crazy week. Did all the negative reporting on potential tariff fallout and fearmongering make an impact on consumer sentiment? It seems likely.

This market will settle down soon enough and positive economic news will begin to be noticed and appreciated. Until it does, we say this: Don’t let the negativity in. Markets may have had quite enough negativity for a while, and hopefully markets will soon be trending upward.

Coming this week

- Not much will happen this week with data. Look for another volatile and tumultuous week governed by tariff news.

- We’ll have a bunch of Fed speakers who may or may not provide any meaningful insights on the direction of interest rates. Right now, the noise is too loud from the evolving tariff situation for anything these individuals say to make much of an impact.

- On Tuesday, we’ll get the Empire State manufacturing numbers. More interestingly, we’ll also see the import price index, which may provide some insight into the impact of the tariffs.

- We will see retail sales, industrial production, capacity utilization, business inventories and MBA mortgage applications on Wednesday. Then we’ll get weekly unemployment and the Philly Fed manufacturing survey on Thursday. We’ll end the week with more Fed speakers on Friday.

Sources:

1 George Magnus. The Guardian. April 14, 2025. “Sky-high US-China tariffs are a mutual trade embargo that will hurt both sides.” https://www.theguardian.com/business/2025/apr/14/sky-high-us-china-tariffs-are-a-mutual-trade-embargo-that-will-hurt-both-sides. Accessed April 14, 2025.

2 Rob Wile, Colleen Long and Shannon Pettypiece. NBC News. April 9, 2025. “Trump suddenly backs off major tariff plan after days of economic and market turmoil.” https://www.nbcnews.com/business/economy/trump-tariffs-president-announces-90-day-pause-what-to-know-rcna200463. Accessed April 14, 2025.

3 Joe Cash and Yukun Zhang. Reuters. April 11, 2025. “China raises duties on US goods to 125%, calls Trump tariff hikes a ‘joke.’” https://www.reuters.com/world/china/china-increase-tariffs-us-goods-125-up-84-finance-ministry-says-2025-04-11/. Accessed April 14, 2025.

4 Samantha Subin. CNBC. April 9, 2025. “Nasdaq rallies most since 2001, notches second-best day ever as Apple soars 15%.” https://www.cnbc.com/2025/04/09/apple-bounces-3percent-after-worst-losing-streak-since-2000-tech-stocks.html. Accessed April 14, 2025.

5 John Towfighi, David Goldman and Anna Cooban. CNN. April 9, 2025. “US stocks skyrocket higher after Trump signals shift in trade policy.” https://www.cnn.com/2025/04/09/investing/global-stock-market-reciprocal-tariffs-hnk-intl/index.html. Accessed April 14, 2025.

6 Lisa Mascaro and Kevin Freking. AP. April 10, 2025. “House approves budget framework for Trump’s ‘big’ bill after intense wrangling sways GOP holdouts.” https://apnews.com/article/house-speaker-johnson-trump-budget-gop-holdouts-960e539ec369d7a799c33d4f3d798976. Accessed April 14, 2025.

7 CME Group. “FedWatch.” https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Accessed April 14, 2025.

8 Yahoo! Finance. “CBOE Volatility Index (ˆVIX).” https://finance.yahoo.com/quote/%5EVIX/. Accessed April 14, 2025.

9 PYMNTS. April 9, 2025. “Goldman Sachs Withdraws Recession Prediction After Trump Pauses Tariffs.” https://www.pymnts.com/economy/2025/goldman-sachs-withdraws-recession-prediction-after-trump-pauses-tariffs/. Accessed April 14, 2025.

10 Siddarth S. Reuters. April 5, 2025. “Global brokerages raise recession odds; J.P. Morgan sees 60% chance.” https://www.reuters.com/markets/jpmorgan-lifts-global-recession-odds-60-us-tariffs-stoke-fears-2025-04-04/. Accessed April 14, 2025.

11 Bureau of Labor Statistics. April 10, 2025. “Consumer Price Index — March 2025.” https://www.bls.gov/news.release/pdf/cpi.pdf. Accessed April 14, 2025.

12 Bureau of Labor Statistics. April 11, 2025. “Producer Price Index News Release Summary.” https://www.bls.gov/news.release/ppi.nr0.htm. Accessed April 14, 2025.

Securities and advisory services offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC and a registered investment advisor. MAS and Vineyard Financial are not affiliated entities.

AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IAR) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM.

Information regarding the RIA offering the investment advisory services can be found on https://brokercheck.finra.org/.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information and opinions contained herein, provided by third parties, have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management.

This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

4/25 – 4363597-2

Ready to Take

The Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.